Focus Your Savings

You may need more than a traditional savings account can provide. Whether you’re seeking to earn a better interest rate or to save more aggressively for retirement, Banterra has what you need. We offer certificates of deposit and individual retirement accounts to allow you to create a focused saving strategy. Get started by applying online.

APPLY NOWCertificates Of Deposit

Banterra’s certificates of deposit (CDs) allow you to earn a higher interest rate than other savings accounts by locking in your rate for the entire term of the certificate. Terms range in length from 30 days to four years and funds cannot be withdrawn early from the account without penalty. Interest may be credited, compounded, or transferred monthly, quarterly, semi-annually, or annually depending on the CD term you select. Each of these CDs are available for personal or business customers. Ask a Banterra representative for more information.

| Term Length | Minimum Deposit* | Ability To Make Additional Deposits | Additional Benefits |

|---|---|---|---|

| 30 days up to and including 90 days | $1,000 | Not available | N/A |

| Greater than 90 days but less than 1 year | $1,000 | Not available | N/A |

| 1 year to less than 24 months | $1,000 | Not available | N/A |

| 24 months to less than 48 months | $1,000 | Not available | N/A |

| 48 months or longer | $1,000 | Not available | N/A |

| Flex 7-11 months | $5,000 | Can make additional minimum deposits of $500 up to 30 days prior to maturity | N/A |

| 15-month Freedom CD | $25,000 | Can make additional minimum deposits of $1,000 up to 30 days prior to maturity | Can make one penalty-free withdrawal during term (balance cannot fall below $10,000) |

| 48-month Bump-Up CD | $10,000 | Not available | One (1) time during the term of the CD, you may request that the interest rate be "bumped up" to the current stated rate for the product. No bump allowed 30-days prior to CD maturity. |

*6,12,15 and 18-month CDs opened online require a $5,000 minimum deposit to open.

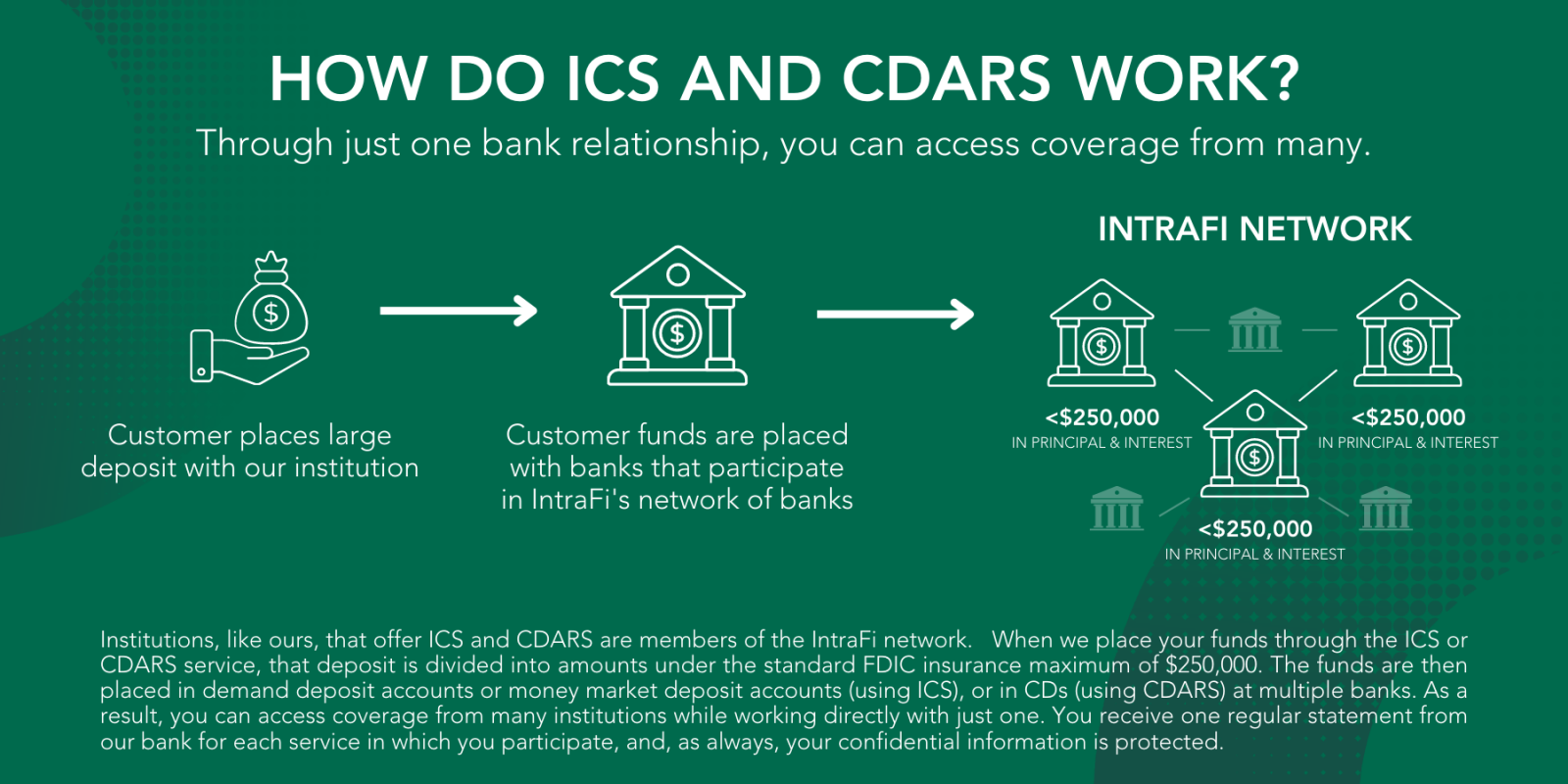

Earn Interest And Access Multi-Million-Dollar FDIC Insurance With IntraFi® Network Deposits

With IntraFi, Banterra can offer smart and convenient ways to safeguard your large deposits by using a network of banks, but with the simplicity of working with just Banterra. IntraFi product offerings include ICS (IntraFi Cash Service) - funds placed into savings or money market accounts and CDARS - funds placed into CDs.

With ICS and CDARS services, you can:

- Enjoy peace of mind knowing your funds are eligible for multi-million-dollar FDIC insurance

- Earn interest

- Save time by working directly with our bank

- Enjoy flexibility

- Know the amount of your deposit can be used to invest in your local community

By accessing the Youtube.com link above, you are leaving the Banterra Bank website and entering a website hosted by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Banterra Bank website. We encourage you to read our Terms of Use section regarding the use of links from Banterra Bank website.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, CDARS, One Bank One Rate One Statement are registered trademarks, and the IntraFi logo and IntraFi hexagon are service marks, of IntraFi Network LLC.

Retirement Accounts

Saving for your retirement is something you need to prepare for now, no matter where you’re at in your career. Banterra offers two different individual retirement account (IRA) options. Both accounts have different impacts on your taxes, so we recommend you consult with your tax advisor to determine which account is the right choice for you. Click the button below to learn more about the IRAs we offer.