Manage Your Money, Your Way

Automate processes for your business with a sweep account from Banterra. With this service, you have the ability to sweep excess funds into another account of your choosing. This allows you to consolidate funds and reduce expenses while keeping your funds accessible. Contact Banterra or schedule an appointment with our Treasury Management team to learn more.

Zero-Balance Accounts

A zero-balance account is precisely what its name suggests: a business checking account that maintains a zero balance at the end of each day. Here’s how it works:

Fund Movement: When your business needs funds, the exact amount is transferred from a connected “parent” account into the zero-balance accounts. These funds can be used to cover expenses such as payroll, petty cash, and departmental needs.

Automatic Sweeping: Any remaining funds in the accounts at the end of the day are automatically swept back into the main account. This ensures that idle cash doesn’t sit idle; instead, it can earn interest in the main account, often at a more favorable rate.

Centralized Control: These accounts are sometimes referred to as subsidiary accounts. They allow businesses to maintain control over multiple disbursement accounts while minimizing excess balances.

Benefits To Your Company

Centralized Cash with Flexibility: By keeping the bulk of your funds in a primary account and maintaining several zero-balance accounts, you optimize your cash flow. Instead of leaving cash idle, you can move it into different child accounts when you want to invest or seize other opportunities.

Easier Budget Management: Especially for larger businesses, managing multiple accounts can become complex. Zero-balance accounts allow you to have an array of dedicated accounts that are well-organized and streamlined.

Reduced Errors: Zero-balance accounts help business owners better track their financials, prevent auditing disasters, and avoid fraud. Automation reduces the risk of manual errors.

Cost-Effective: Unlike traditional accounts that require a minimum balance, zero-balance accounts operate without maintaining a balance. This cost-effectiveness benefits small business owners.

Line Of Credit Sweep

A line of credit sweep account is a financial tool that allows businesses to optimize their cash flow by automatically managing funds between a checking account and a line of credit. Here’s how it works:

Excess Funds Utilization: When your checking account balance exceeds a predetermined threshold, the system sweeps the excess funds from the checking account into your line of credit. This ensures that idle cash is put to work, reducing interest expenses.

Automatic Transfers: At the end of each business day, the system automatically transfers funds from your line of credit back into your checking account if the checking account balance falls below the threshold. This prevents overdrafts and maintains liquidity.

Benefits To Your Company

Interest Expense Reduction: By sweeping excess funds into your line of credit, you effectively reduce the outstanding balance on the credit line. As a result, you pay less interest on the borrowed amount.

Improved Financial Control: Line of credit sweeps provide businesses with better control over their cash flow. Instead of manually monitoring and moving funds, the process is automated. You can focus on running your business while the system optimizes your funds.

Liquidity Management: The automatic transfers ensure that your checking account remains at an optimal level. If unexpected expenses arise, you can draw from the line of credit to replenish the funds.

Efficiency and Time Savings: With line of credit sweeps, you don’t need to constantly monitor balances or manually transfer funds. Automation streamlines the process, allowing you to allocate your time more efficiently.

Earn Interest And Access Multi-Million-Dollar FDIC Insurance With IntraFi® Network Deposits

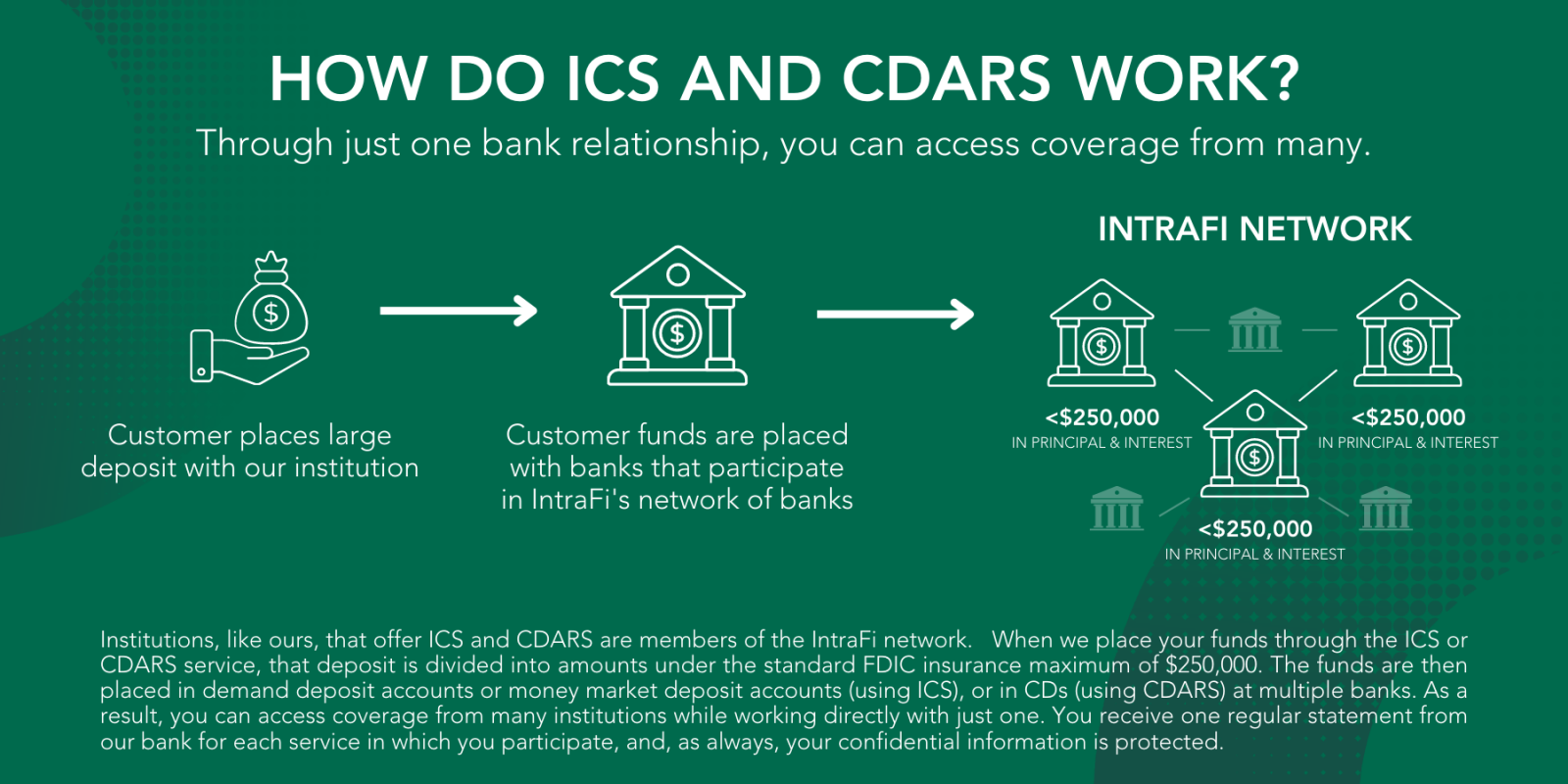

With IntraFi, Banterra can offer smart and convenient ways to safeguard your large deposits by using a network of banks, but with the simplicity of working with just Banterra. IntraFi product offerings include ICS (IntraFi Cash Service) - funds placed into checking/demand deposit or money market accounts and CDARS - funds placed into CDs.

With ICS and CDARS services, you can:

- Enjoy peace of mind knowing your funds are eligible for multi-million-dollar FDIC insurance

- Earn interest

- Save time by working directly with our bank

- Enjoy flexibility

- Know the amount of your deposit can be used to invest in your local community

By accessing the Youtube.com link above, you are leaving the Banterra Bank website and entering a website hosted by another party. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Banterra Bank website. We encourage you to read our Terms of Use section regarding the use of links from Banterra Bank website.

Deposit placement through CDARS or ICS is subject to the terms, conditions, and disclosures in applicable agreements. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA (e.g., before settlement for deposits or after settlement for withdrawals) or be uninsured (if the placing institution is not an insured bank). The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through CDARS or ICS satisfies any restrictions on its deposits. A list identifying IntraFi network banks appears at www.intrafi.com/network-banks. The depositor may exclude banks from eligibility to receive its funds. IntraFi, CDARS, One Bank One Rate One Statement are registered trademarks, and the IntraFi logo and IntraFi hexagon are service marks, of IntraFi Network LLC.